We partnered with Quantum Workplace, a leading workplace survey and employee feedback technology company, to find out exactly what motivates employees to be their best. We analyzed feedback from nearly 2,000 survey responses to produce the report “Workplace Well-Being: Provide Meaningful Benefits to Energize Employee Health, Engagement, and Performance.” Check out our top level findings and read through our workplace well-being blog series as we unpack the data.

An employee’s financial well-being is just as important as their mental and physical health. Financial strain can cause extra stress outside of work that can affect on the job performance.

Your employees’ financial stress affects your company’s output more than you may realize. Nearly half of American full-time workers say they worry about personal finances during work hours. And 29 percent say they deal with personal financial issues on the job – often for two to three hours a week.

What is the one financial wellness benefit that could reduce that amount of time spent worrying about personal finances?

The crucial employee financial well-being benefit you’re not providing: standard-of-living raises

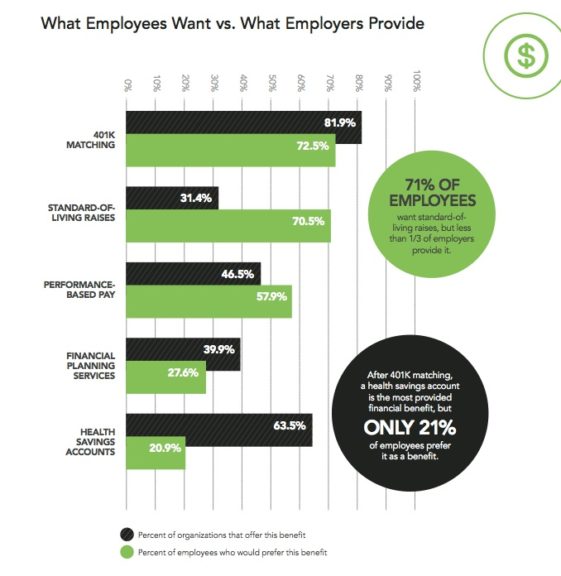

While nearly 82 percent of employers are offering 401k matching, only 31 percent are offering cost of living raises. Not providing these raises might be costing you more than you think.

Employees are 14.8 percent more engaged when provided standard-of-living raises.

How to prioritize employee financial wellness

Use this as an opportunity to re-evaluate your benefits strategy. You may be able to move funds from benefits that are underutilized or under appreciated. While our research is compelling, it’s imperative for you to survey the needs for your unique workforce.

For example, we found that while health savings accounts are the second most provided financial benefit, they have the lowest demand.

We also found that age could be a huge factor for your strategy. We found that employees 25 years old and younger are nearly twice as likely to prefer financial planning services, compared to employees 56 years old and older.

Want some quick thoughts on what to do? Read about our top tips for supporting financial well-being.

And if you want to learn more about the current state of employee well-being and engagement, download the full report, including resources for building a successful employee engagement program.