Press

Read the latest Limeade news and workplace well-being trends.

Media Contact: press@limeade.com

News Coverage

WebMD Health Services Completes Acquisition of Limeade

Well-being is Better Together with WebMD Health Services + Limeade.

News Coverage

WebMD Health Services to Acquire Limeade

WebMD and Limeade come together to deliver the most comprehensive well-being solution in the market.

Press Release

Limeade Appoints Lauren Chucko as Chief Customer Officer, Demonstrating Commitment to Exceptional Customer Experiences

Chucko’s new role underscores the company’s commitment to rally around its customer-centric vision, uniting all departments to deliver exceptional and consistent experiences.

Press Release

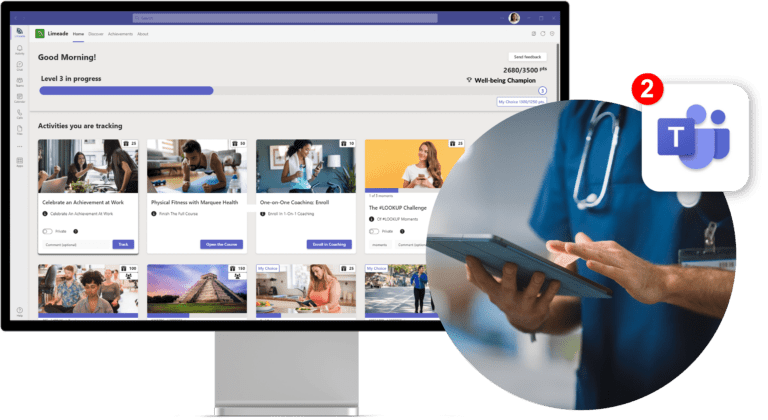

Limeade Integrates with Microsoft Teams to Infuse Well-Being into the Flow of Work

The new Limeade for Microsoft Teams integration positively transforms the employee experience by infusing well-being into the flow of work.

Press Release

Limeade Announces Cy Wakeman as Keynote Speaker for LimeTime to Inspire Change and Cultivate Care in the Workplace

New York Times best-selling author Cy Wakeman will headline LimeTime, a new quarterly event series aimed at infusing care in the workplace

Press Release

Limeade Announces Dave Smith as New President and Chief Operating Officer

Limeade, an immersive employee well-being company that creates healthy employee experiences, announced the promotion of Dave Smith from GM of the TINYpulse division to President and Chief Operating Officer, reporting to CEO Henry Albrecht.

Press Release

Limeade Appoints Alan Saporta as Chief Technology Officer

Limeade announced Alan Saporta as Chief Technology Officer (CTO), leading the charge in delivering the technology vision and roadmap for the Limeade platform and solutions.

Press Release

Limeade Hires Industry Veteran Kathy Xanthos as New Chief Information Security Officer, Promotes Sarah Visbeek to General Counsel

Today, immersive well-being software leader Limeade announced another milestone in leadership with the appointment of Kathy Xanthos as Chief Information Security Officer (CISO)

Press Release

Limeade Appoints Global Software, Technology, and Finance Executive Lisa Nelson to its Board of Directors

Today, immersive well-being software leader Limeade announced that Lisa Nelson joins Limeade as a new Non-Executive Director of the Board of Directors, effective immediately.

Press Release

Limeade Outpaces Industry in Gender Representation, Reporting 51% Women Across Global Workforce

Limeade released new employment data demonstrating concentrated focus on increasing gender representation across its global workforce. As of February 2022, Limeade reported 51% women make up the employee population and 48% of director-level and above leadership roles are held by women.